How To Get A Mortgage After Bankruptcy

How To Get A Mortgage After Bankruptcy

While it may not seem like it, bankruptcy can actually be a good thing for people that find themselves drowning in debt. Bankruptcy is more or less a last-ditch effort to help people that have no other way out of their financial quick sand that they may find themselves in. It gives you a chance to start fresh after liquidating all their assets or paying off debts in a structured manner over the course of a set number of years if you choose chapter 13. Declaring bankruptcy gets the creditors and collection agencies off your back and gives you a chance to focus on rebuilding your financial life.

When you declare bankruptcy, it appears on your credit history that you took this action. Bankruptcy tells lenders and creditors that you did not pay all the money back to previous lenders and creditors and this could scare some lenders however, getting a home may have some strings attached but it is not impossible.

Take Baby Steps

The first thing to keep in mind is that building up credit, whether good or bad, can take time. However, declaring bankruptcy wipes out your credit history and that means any good credit marks you have may also be tarnished for a while.

You will basically be starting over on the road to building your credit history and best thing to do is to be proactive and to be able to show lenders what you have done to turn over a new leaf. Explaining to them what you will be doing is not effective as they want actions, signs, and wonders. A good rule of thumb is to build up your good credit again and then wait about two years before considering a mortgage. I see a lot of things with my faith eyes and just because your mama had to wait 2 years it does not mean that you will have to.

One option is to look into special government programs for those whom may have had financial challenges in the past. There are some programs that give you the option to put less money down even if you have gone through bankruptcy. For someone with steady income and working to reestablish their credit they have a fair chance at qualifying for some of these government programs.

After a Chapter 7 Bankruptcy Discharge

After being discharged many say that it can take up to two years before you can qualify for a home however, I have known the process to take less than that. Please be mindful that your discharge date is different from your filing date so don’t go file today and expect to be in a home in 2 weeks.

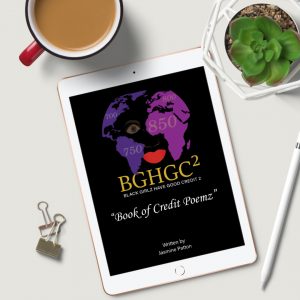

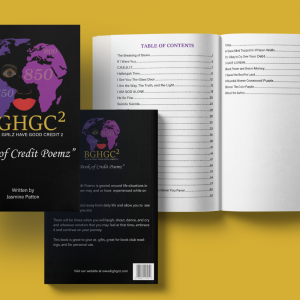

Below are some different lender choices that could be helpful to you:

Federal Housing Authority (FHA) Loan

Is a federally insured loan in which credit score requirements are more liberal, for example some one with a score of 500 may have to put 10% down. However, I definitely encourage you to continue to increase your scores as this would be a great program for first time home buyers because it will allow you to put down as little as 3.5% down for your purchase

United States Department of Agriculture (USDA) Loan

Low- and middle-income borrowers willing to purchase a home in a rural community will benefit from this loan. It offers a low-interest and no down payment options for those who might not otherwise be able to qualify for conventional financing.

Applicants will be eligible for this loan three years after receiving a Chapter 7 discharge. However, if you qualify for the exceptional circumstances exception—for instance, by demonstrating that the bankruptcy was beyond your control and not a result of financial mismanagement—you might be able to qualify as soon as 12 months after the discharge.

In addition, a Chapter 13 bankruptcy filer can apply after 12 months of successful plan payments or sooner on a showing of exceptional circumstances.

Veteran’s Affairs (VA) Loan

The VA loan program is a benefit given to veterans to help with housing needs which offer no down payment, no minimum credit score, greater allowance of seller credits and concessions than other loans, and unlimited use of the loan program.

The VA considers your credit re-established after bankruptcy when you’ve had two years of clean credit. Keep in mind, however, that individual lenders participating in the VA program can require a specific credit score.

Also, even though a bankruptcy, foreclosure, or low credit score will not disqualify you automatically, there’s an exception: You’ll have to pay back any money owed if you previously purchased a house with a VA loan and lost it due to foreclosure.

NACA Program- Not government funded but I wanted to throw it out there

NACA offers a wide range of homeownership assistance programs, including property renovation and foreclosure prevention, as well as a Home Save Program intended to help struggling homeowners avoid foreclosure by restructuring their mortgage to reduce interest rates and monthly payments.

For a Member to be NACA Qualified means that they are pre-approved for the NACA Mortgage and ready for the housing search. NACA Qualification means that a Member is ready for homeownership with an affordable mortgage payment. Being NACA Qualified makes one a desirable buyer for agents to work with and sellers to sell to.I have known several people to use the program to start over and all said that is was a very structured program, but it was worth the wait.