I Am Finally Discharged. Now What?

I Am Finally Discharged. Now What?

It is a good possibility that after you complete the bankruptcy process that you will need to get a loan or even get better terms on current debts. The idea of getting a loan after coming out of bankruptcy is one that can be scary, but you need dirt to grow.

Let’s take the time to go over the steps to get yourself back on course if you are thinking about refinancing or getting a loan following bankruptcy:

Discharged

After being discharged, start re-establishing yourself by showing a strong pay history and more than likely you will be successful with getting a new line of credit. If you did not include your bank in bankruptcy, talk with a representative and explain to them your situation as they may be able to assist with you furthering establishing yourself.

Death to Late Payments

Late payments on bills are not a good sign to creditors especially after bankruptcy so make sure that as you establish new debt that you don’t get in over your head. Paying your bills on time can be as simple as not living above your means and limiting yourself to only one credit card for emergency funds purposes only. Showing good credit history after bankruptcy is imperative and being responsible with your credit can show the banks a positive side of you because we all know that its there.

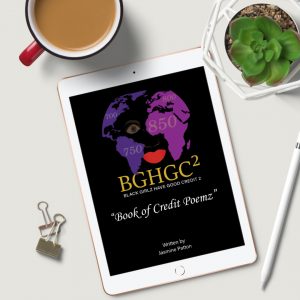

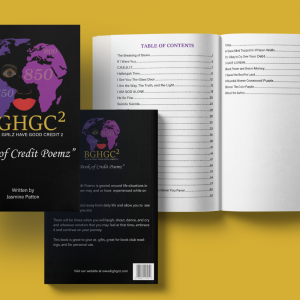

Rebuilding

Rebuilding your credit is not your only task in this process as you will also need to remove any mistaken information that you may find on your credit report and this can be done by getting a FREE copy of your credit report from the 3 major credit bureaus (https://www.annualcreditreport.com/index.action). You are in the rebuilding phase and you don’t want your old life trying to find you again as this will go a long way towards helping you get loans and refinanced after bankruptcy because it will raise your credit scores.

Another good trick to helping with debts after bankruptcy is to obtain a loan on the value of your property. These types of loans are given based on the cash value of your property and are good for paying off any outstanding taxes or other debts you have.

There is More

There are several resources available to people who have gone through bankruptcy. There are loan officers and mortgage lenders that specialize in loans and refinancing options for people who have gone through this so take advantage of their knowledge and use it for your good. Don’t be ashamed of your bankruptcy when seeking help as they are there to help you succeed. Remember, the more they help you grow the more of an asset you can become to them.

With a little patience and understanding, you can get through bankruptcy and have a financial life after the process is complete so do not let anyone tell you that bankruptcy is the end of the road for you.